The 8-Minute Rule for Mortgage Brokerage

Wiki Article

See This Report on Mortgage Brokerage

Table of ContentsHow Broker Mortgage Meaning can Save You Time, Stress, and Money.Fascination About Broker Mortgage Near MeThe Greatest Guide To Mortgage Broker Vs Loan OfficerExamine This Report on Broker Mortgage RatesMortgage Broker Assistant - TruthsFascination About Broker Mortgage CalculatorNot known Factual Statements About Mortgage Broker Association The Best Guide To Mortgage Broker Assistant

A broker can contrast loans from a bank as well as a credit score union. A lender can not. Banker Income A home loan lender is paid by the establishment, generally on a wage, although some institutions supply economic motivations or rewards for efficiency. According to , her initial duty is to the establishment, to ensure finances are effectively secured as well as the borrower is completely qualified as well as will make the finance settlements.Broker Commission A mortgage broker stands for the debtor extra than the loan provider. His responsibility is to obtain the customer the finest deal possible, no matter the organization. He is generally paid by the lending, a type of compensation, the difference between the rate he obtains from the loan provider and the price he supplies to the consumer.

Some Known Incorrect Statements About Mortgage Broker Assistant

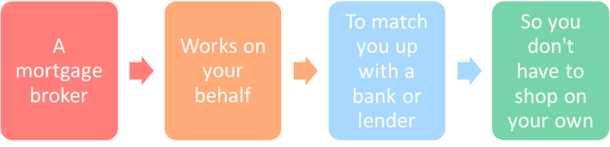

Jobs Defined Recognizing the advantages and disadvantages of each may assist you decide which profession path you want to take. According to, the major difference in between the 2 is that the financial institution mortgage policeman stands for the items that the bank they benefit offers, while a mortgage broker deals with multiple lenders as well as acts as an intermediary between the loan providers and also customer.On the various other hand, bank brokers may discover the job ordinary eventually because the procedure typically stays the exact same.

The Facts About Broker Mortgage Rates Uncovered

What Is a Lending Police officer? You may recognize that finding a car loan police officer is an important action in the procedure of acquiring your car loan. Let's discuss what lending policemans do, what understanding they require to do their work well, as well as whether loan police officers are the most effective choice for borrowers in the loan application testing process.

The Of Mortgage Broker Vs Loan Officer

What a Car loan Officer Does, A funding policeman helps a bank or independent loan provider to help borrowers in requesting a funding. Because many customers work with car loan officers for home loans, they are usually referred to as home mortgage loan policemans, though several lending officers assist consumers with various other car loans.If a financing officer thinks you're eligible, then they'll recommend you for authorization, and you'll be able to continue on in the process of getting your funding. What Loan Policemans Know, Lending policemans should be able to work with consumers and also little business owners, as well as they must have extensive expertise concerning the sector.

Not known Details About Mortgage Broker Assistant

How Much a Financing Policeman Expenses, Some financing police officers are paid via compensations (mortgage broker assistant job description). Home mortgage financings have a tendency to result in the biggest commissions since of the size and work linked with the financing, yet compensations are frequently a flexible prepaid cost.Financing policemans understand everything about the many kinds of car loans a loan provider may supply, and also they can provide you recommendations about the best choice for you and your click over here now circumstance. Discuss your demands with your loan police officer. They can aid route you towards the best car loan kind for your situation, whether that's a standard finance or a jumbo lending.

The 9-Minute Rule for Mortgage Broker Average Salary

The Function of a Financing Policeman in the Screening Refine, Your lending policeman is your direct get in touch with when you're applying for a financing. You will not have to fret regarding regularly calling all the individuals entailed in the home more tips here mortgage finance procedure, such as the expert, actual estate representative, settlement attorney and others, due to the fact that your financing officer will be the point of get in touch with for all of the included celebrations.Since the process of a finance deal can be a facility as well as costly one, numerous customers favor to collaborate with a human being instead than a computer system. This is why banks might have numerous branches they want to offer the possible consumers in numerous areas that wish to meet in person with a finance officer.

More About Mortgage Broker Average Salary

The Function of a Car Loan Officer in the Funding Application Refine, The home mortgage application process can really feel overwhelming, specifically for the novice property buyer. When you work with the ideal lending officer, the process is really rather easy. When it pertains to getting a home loan, the process can be broken down right into six phases: Pre-approval: This is the stage in which you locate a financing policeman and get pre-approved.During the lending processing phase, your car loan policeman will call you with any type of questions the loan cpus may have about your application. Your finance policeman will after click to read that pass the application on to the expert, that will certainly evaluate your credit reliability. If the expert accepts your car loan, your car loan police officer will then collect and prepare the ideal lending shutting records.

Some Ideas on Mortgage Broker Salary You Need To Know

So exactly how do you pick the appropriate funding police officer for you? To start your search, start with loan providers that have a superb reputation for exceeding their customers' assumptions as well as maintaining market criteria. As soon as you've chosen a lender, you can after that start to tighten down your search by interviewing car loan policemans you may wish to collaborate with (mortgage broker salary).

Report this wiki page